hat is Premium Financing?

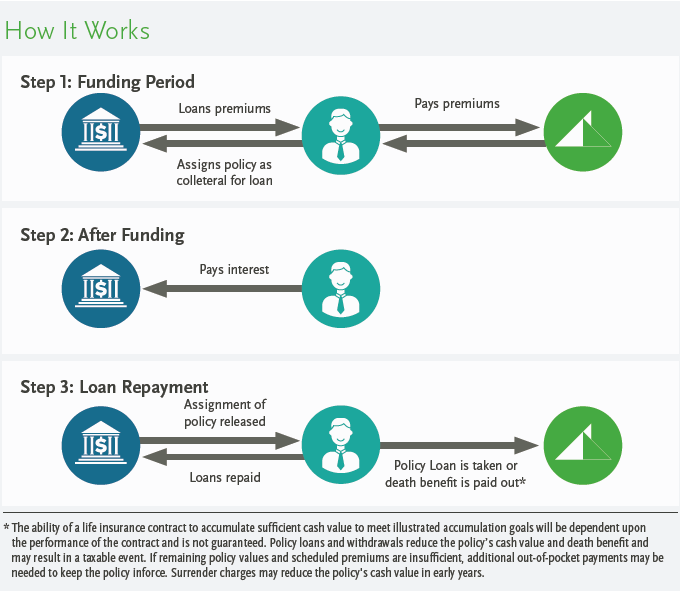

Premium finance is a strategy used by wealthy individuals and business owners to finance premiums for large life insurance policies. The strategy allows a high net-worth individual who has a need for permanent life insurance to use an alternative method for paying the premiums. Rather than using their current cash flow or assets to pay for those premiums, they may choose to finance them from a bank.

Premium finance is a strategy used by wealthy individuals and business owners to finance premiums for large life insurance policies. The strategy allows a high net-worth individual who has a need for permanent life insurance to use an alternative method for paying the premiums. Rather than using their current cash flow or assets to pay for those premiums, they may choose to finance them from a bank.

Premium Finance is NOT

Why Choose Premium Finance?

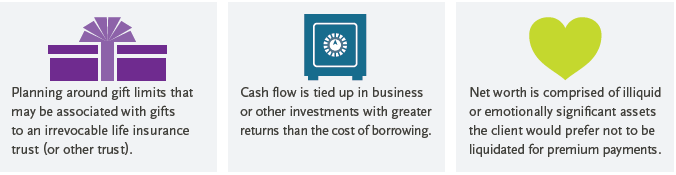

– Planning around gift limits that may be associated with gifts

to an irrevocable life insurance trust (or other trust).

– Cash flow is tied up in business or other investments with greater returns than the cost of borrowing.

– Net worth is comprised of illiquid or emotionally significant assets the client would prefer not to be liquidated for premium payments.

Who is a Good Candidate for Premium Finance?

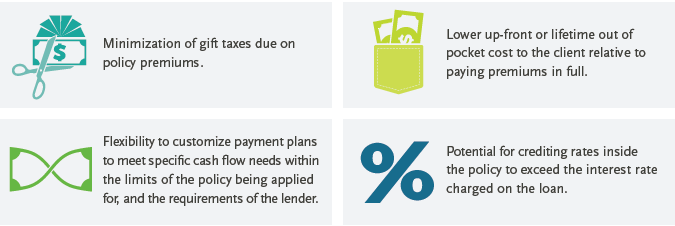

Individuals who are well suited to the strategy have a need for a large amount of life insurance and understand both the power and associated risks, of leverage. Risks associated with premium finance include lender requirements, policy crediting risk, loan interest risk and collateral risk. These risks can have a negative impact on the policy or loan and can create additional costs. These costs could require the client to liquidate assets or allocate additional cash flow or collateral to the arrangement. However, when properly structured, monitored and serviced, premium finance may provide significant savings or other benefits to your clients and help them achieve their policy objectives. These can include:

Just as you might finance a house or a car, you can now finance your benefits. The benefits most executives want and need are:

– Additional cash to supplement retirement income

– Tax-Deferred Growth of the cash value

– The means to obtain tax-free Income from the policy cash value

– Cash for a chronic disability

– Cash for chronic care or long term care (LTC)

– Cash if they become terminally ill

– Tax-Free Death Benefit for their heirs

Employers can offer all the above benefits to their executives as well as protect their business through these more effective solutions:

Living Buy/Sell

Living Key Man

Living Partner Buyout

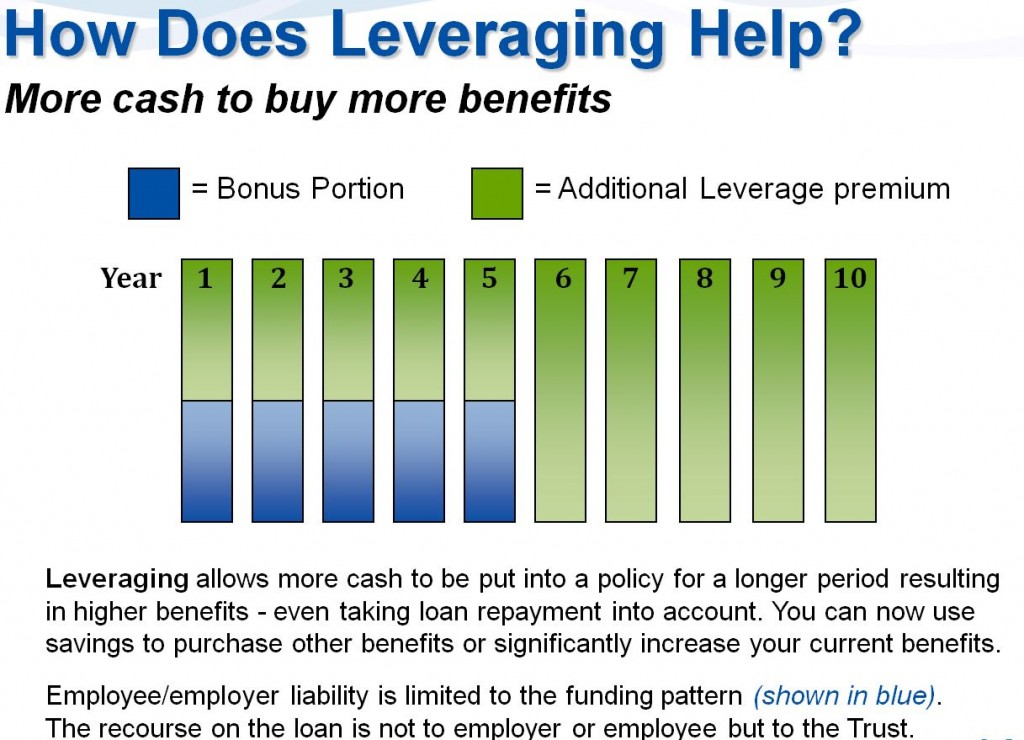

Executive/Employer contributions are made to the plan for only five years. The financing portion matches the contribution for the first five years and then takes over and pays the total contribution for the remaining five years.