IF YOU ARE LIKE MOST PEOPLE YOU ARE ONLY ABLE TO AFFORD A PORTION OF THE BENEFITS THAT YOU TRULY NEED. KAI-ZEN CAN BE THE BEST ANSWER TO BUILD RETIREMENT INCOME THROUGH VALUABLE PERMANENT LIFE INSURANCE WHILE HAVING FINANCIAL PROTECTION IN THE EVEN OF A SERIOUS ILLNESS OR INJURY.

NO COLLATERAL OUTSIDE OF THE POLICY

NO LOAN DOCUMENTS TO SIGN

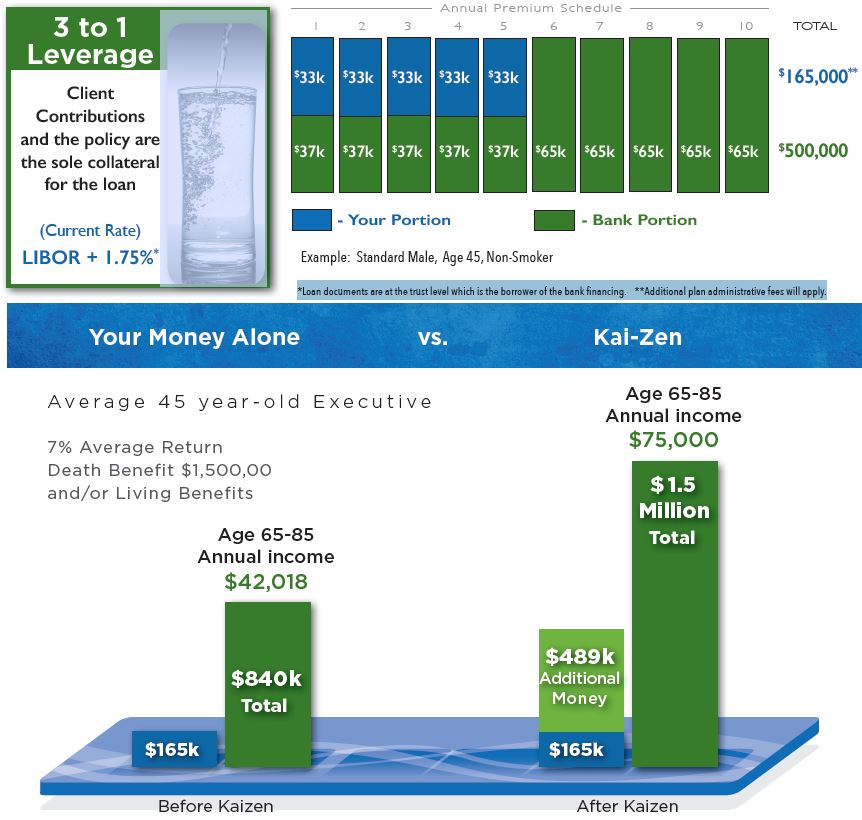

A Kai-Zen Plan is jointly funded by you and by bank financing. This bank financing provides approximately 60-75% of the total contribution to the plan which reduces costs and increases benefits far beyond what your contributions alone might achieve.

EXAMPLE:

FOR MALE 50 STANDARD HEALTH WITH 1.5M DEATH BENEFIT

BUY IUL BORROWING MONEY THROUGH KAI-ZEN: $219,351

BUY IUL USING YOUR MONEY: $628,265

Control your own future

The Kai-Zen Plan is one of the best answers for leveraging your current cash flow to allow you to purchase the amount of life insurance you actually need.

With the Kai-Zen Plan, there are no personal or business loan documents to sign*!

The Kai-Zen Plan is designed for business owners, executives, Professionals, doctors, attorneys or similar key employees. To qualify, you must be able to obtain a standard or better risk class with the carrier, be age 65 or under, and have income of at least $100,000 annually.

Each Kai-Zen Plan participant will own a personal trust which will in turn own their policy. Each year, for up to 5 years, you contribute your portion of the premium to your trust. Your contribution and your policy are the sole collateral for the loan.

*Loan documents are at the trust level which is the borrower of the bank financing. **Additional plan administrative fees will apply.

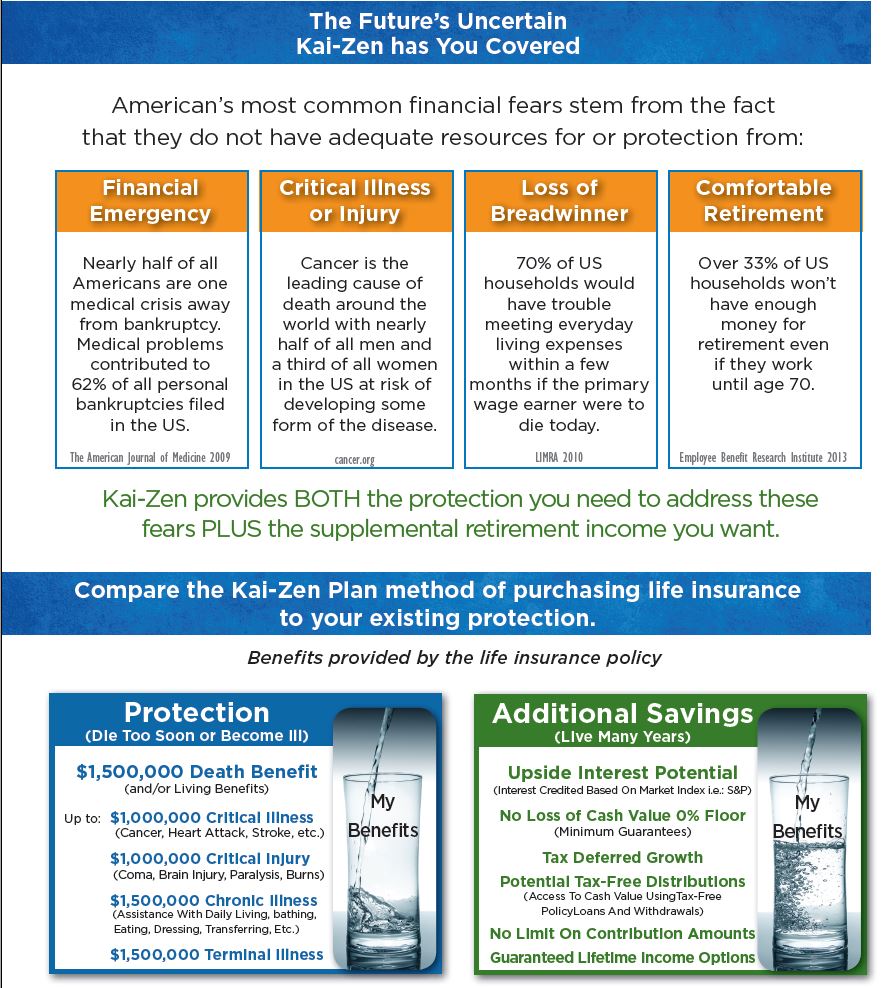

American’s most common financial fears

American’s most common financial fears stem from the fact that they do not have adequate resources for or protection from. Kai-Zen provides BOTH the protection you need to address these fears PLUS the supplemental retirement income you want.

1 Payment of Accelerated Benefits will reduce the Cash Value and Death Benefit otherwise payable under the policy. Receipt of Accelerated Benefits may be a taxable event and may affect your eligibility for public assistance programs. Please consult your personal tax advisor to determine the tax status of any benefits paid under this rider and with social service agencies concerning how receipt of such a payment will affect you. Access to the death benefit may be available through optional accelerated benefit riders in the event of a qualifying terminal, chronic or critical illness. Riders are supplemental benefits that can be added to a life insurance policy and are not suitable unless you also have a need for life insurance. Riders are optional, may require additional premium and may not be available in all states or on all products. This is not a solicitation of any specific insurance policy. Living benefits may not be available with all carriers.

2 Policy loans and withdrawals reduce the policy’s cash value and death benefit and may result in a taxable event. Withdrawals up to the basis paid into the contract and loans thereafter will not create an immediate taxable

event, but substantial tax ramifications could result upon contract lapse or surrender. Surrender charges may reduce the policy’s cash value in early years.

* Financing life insurance premiums has certain inherent risks including interest rate fluctuations, financial marketing performance, credit availability, insurance company ratings, and stability.

14 Feb 2020

14 Feb 2020Perfect Gift for Valentine’s Day

01 Feb 2020

01 Feb 2020PREM FIN CASE: FOREIGN NATIONAL AGE 53

05 Jan 2019

05 Jan 2019EVALUATING RISKS | ASSET & COST OF BORROWING

04 Jan 2019

04 Jan 2019AMERICANS’ GREATEST FINANCIAL FEARS

02 Jan 2019

02 Jan 2019RETAIN, PROTECT & SAVE

01 Feb 2017

01 Feb 2017what if you outlive your retirement income?

01 Feb 2017

01 Feb 2017Maximize Your Pension with Life Insurance

26 Jan 2017

26 Jan 2017Long Term Care

05 Jan 2017

05 Jan 2017Why Disability Insurance?

01 Jan 2017

01 Jan 2017Are You Planning An Early Retirement?