NIVERSAL LIFE

It is common knowledge that life changes. However, what may not be common knowledge is the need to have your life insurance reviewed on a regular basis. Even subtle changes in your personal life could have a dramatic impact on the results you expected when you first put your life insurance policy into force. Moreover, the last decade has seen tremendous changes in life insurance products and the tax environment in which they exist.Considered the most flexible of the three types of life insurance, Universal Life allows you to adjust the amount of your policy, also called the face amount, and the premiums you pay. You also have the potential to build cash value in your policy based on a guaranteed minimum interest rate.1 Like Whole Life, you can build cash value in your policy without paying current income taxes on the increases and you can potentially access the funds on a tax-advantaged basis.

PAY YOURSELF FIRST!

Universal Life’s flexibility allows you to stop paying premiums if there is enough accumulated value in your policy to cover the cost of insurance each month. If you desire, you can then pay additional premiums to build back up accumulated cash value. You may also be able to increase or decrease your death benefit depending on your life insurance needs. An increase may require additional underwriting.

Two of the most popular types of Universal Life insurance are Fixed Universal Life and Indexed Universal Life. One of the main differences between them is in how the policy’s interest is credited. With a Traditional Fixed Universal Life policy there is an interest rate declared by the company that is credited to the policy’s cash value. Indexed Universal Life credits the interest based on the changes in value of a major market index. Both offer you varying degrees of guarantees and returns, based on your appetite for risk.

Indexed Universal Life Insurance is similar to traditional Universal Life Insurance: a type of “permanent life insurance” that features a flexible death benefit, face amount, and premium payments. All Universal Life Insurance policies have the potential to build cash value based on interest credits, the difference with IUL is how interest is credited.

INDEX UNIVERSAL LIFE

Interest Crediting

Cash value accumulation of IUL policies is dependent on the interest crediting rate paid by the insurance company on the premium in excess of the insurance cost.

There are 5 or 6 strategies (depending on product) which credit interest differently. In addition to a Fixed Interest Crediting Strategy, there are several Indexed Strategies that are based on the changes in the S&P 500® or MSCI Emerging Markets Index. Changes in the markets are measured through a Point-to-Point, or Point-to-Average Strategy. Depending on product and strategy elected, interest is credited up to a specific “Cap Rate” (if applicable) and “Participation Rate”.

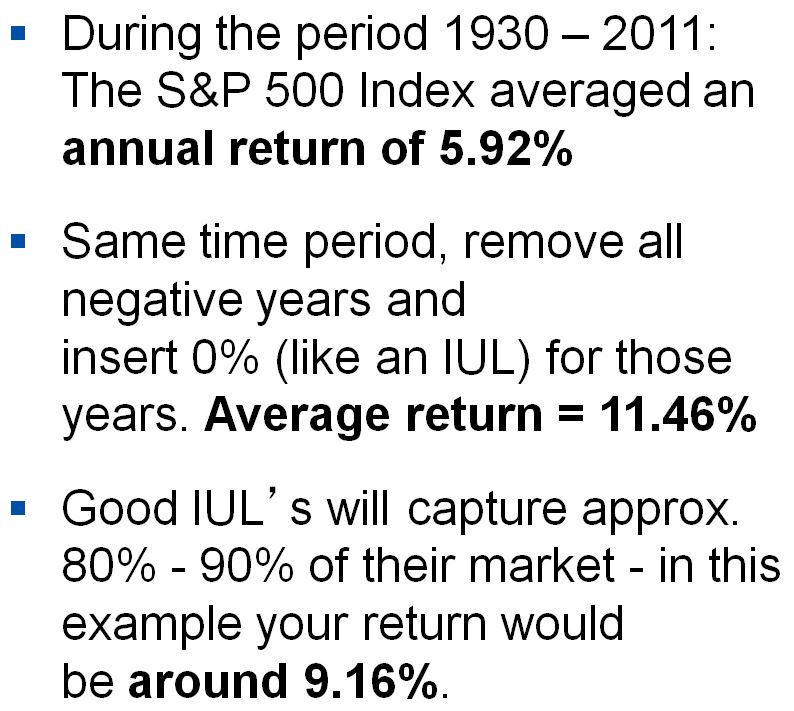

Upside Potential – is the potential for cash value accumulation based on the positive growth of the major market index.

Downside Protection – is the guaranteed 0% floor provided in the event of a decline in the index.

Max Fund The Policy – IUL products, by design, perform best when fully funded. The more money put into the policy the more efficient it becomes.

Indexed Universal Life Offers Death Benefit and Potential Cash Value Accumulation

Life insurance creates an immediate reservoir of funds that, at death, can be used to help protect the financial security of your family or to help maintain your business. The purpose of life insurance is to ensure that those who depend on you will still be able to maintain their standard of living if something should happen to you. Life insurance helps secure your loved ones’ futures and potentially provide them with enough money to fulfill their obligations and pursue their dreams, even if you are no longer with them.

All life insurance policies operate under the same general structure. You make payments, also known as “premiums”, to a life insurance company. In return, the company agrees to pay a specified amount to whomever you designate to receive the money from your policy when you pass away.

Universal Life insurance is a type of “permanent” life insurance, that allows you to adjust the amount of your policy, also called the face amount, and the premiums you pay.1 All permanent life insurance policies offer the potential to build cash value on a tax-deferred basis, which may be accessed income tax-free during your lifetime through withdrawals and loans.2 One type of universal life insurance is called Indexed Universal Life (IUL). With IUL, the cash value accumulation is dependent on the interest crediting rate paid by the insurance company on the premiums in excess of the insurance costs. Besides the fixed interest crediting strategy, our IUL products offer the option to have interest credited based on the changes in the S&P 500® and MSCI Emerging Markets Index through the Point-to-Average strategy or the Point-to-Point strategy.

14 Feb 2020

14 Feb 2020Perfect Gift for Valentine’s Day

01 Feb 2020

01 Feb 2020PREM FIN CASE: FOREIGN NATIONAL AGE 53

05 Jan 2019

05 Jan 2019EVALUATING RISKS | ASSET & COST OF BORROWING

04 Jan 2019

04 Jan 2019AMERICANS’ GREATEST FINANCIAL FEARS

02 Jan 2019

02 Jan 2019RETAIN, PROTECT & SAVE

01 Feb 2017

01 Feb 2017what if you outlive your retirement income?

01 Feb 2017

01 Feb 2017Maximize Your Pension with Life Insurance

26 Jan 2017

26 Jan 2017Long Term Care

05 Jan 2017

05 Jan 2017Why Disability Insurance?

01 Jan 2017

01 Jan 2017Are You Planning An Early Retirement?