ISABILITY INSURANCE

Your paycheck allows you to provide for your family and lifestyle. It’s the source we rely on to meet our essential needs as well as some luxuries.

What happens when a sickness or injury prevents you from going to work and earning that paycheck? How would it impact your life?

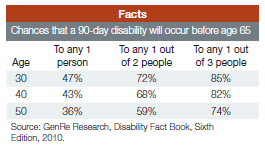

The risk of total disability is greater than the risk of death between ages 20 and 65. Below are facts that illustrate the chance of becoming disabled at ages 30, 40, and 50. The more employees you have, the greater chance that one of them will become disabled before age 65. The more time your employees have until they reach age 65, the greater their chance of becoming disabled in that time.

The risk of total disability is greater than the risk of death between ages 20 and 65. Below are facts that illustrate the chance of becoming disabled at ages 30, 40, and 50. The more employees you have, the greater chance that one of them will become disabled before age 65. The more time your employees have until they reach age 65, the greater their chance of becoming disabled in that time.

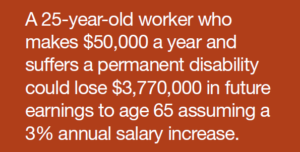

Disability insurance provides partial income so you can pay your bills if you get too sick or injured to work. Disability happens to more people, more often than you may think. In fact, more disabilities are caused by illness than injury, including common conditions like heart disease and arthritis, and most disabilities are not covered by Workman’s Compensation.Accidents happen, and we can’t always anticipate if or when we’ll be diagnosed with an illness, condition, or injury, which is why it’s important to have a disability policy that will help you pay your bills in the event that you can’t collect your normal paycheck from work.

Some employers will offer short and long term disability benefits to their employees. Short-term policies help you immediately after an incident, and long-term policies help provide financial protection for disabilities that can last for years. You can also pay for additional coverage on top of the benefits you get at work to help provide extra financial protection.

14 Feb 2020

14 Feb 2020Perfect Gift for Valentine’s Day

01 Feb 2020

01 Feb 2020PREM FIN CASE: FOREIGN NATIONAL AGE 53

05 Jan 2019

05 Jan 2019EVALUATING RISKS | ASSET & COST OF BORROWING

04 Jan 2019

04 Jan 2019AMERICANS’ GREATEST FINANCIAL FEARS

02 Jan 2019

02 Jan 2019RETAIN, PROTECT & SAVE

01 Feb 2017

01 Feb 2017what if you outlive your retirement income?

01 Feb 2017

01 Feb 2017Maximize Your Pension with Life Insurance

26 Jan 2017

26 Jan 2017Long Term Care

05 Jan 2017

05 Jan 2017Why Disability Insurance?

01 Jan 2017

01 Jan 2017Are You Planning An Early Retirement?